on Jan 17, 2013

Banks tighten their squeeze to extract fees

Happy New Year! As the mayans are saying, Welcome to a new Era! As we look into an exciting new year, we are working to endeavour our new savings goals, fitness regimes and keeping pace with the everchanging world that we live in. This blog posting is focused on what our banks are doing to keep up their profits and retain your business. Good to know information since it is likely to become a banking standard across many other financial institutions.

It's no secret that Banks are always looking for ways to increase profits and of course their retention. When wanting to break your mortgage, the penalty is understandable, but the additional fees are absolutely gross!! Here are the fees you might expect to see on your payout statement:

"A prediction for 2013: Expect your bank to squeeze you harder than ever with fees."

After releasing fourth-quarter earnings a month or so back, bank executives said low interest rates and slower growth in borrowing would result in diminished profit growth in 2013. Now, how do you suppose the banks will try to offset lower revenues?

For answers, let’s look into two situations from late 2012 involving new or egregious bank fees. These stories are instructive in showing the need for vigilance in all your bank dealings.

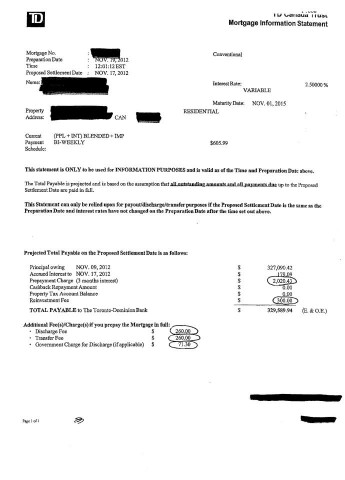

The first situation involves fees listed in a quote supplied by Toronto-Dominion Bank to a TD Canada Trust customer who was interested in breaking a mortgage. The actual quote, stripped of personal information, was sent to me by veteran mortgage broker Vince Gaetano, whose firm, MonsterMortgage.ca, works with the person who wanted out of the mortgage.

Surprisingly, it’s not the amount of the mortgage penalty that was in question. On a $327,090.42 balance, the penalty was quoted at $2,020.43. The amount is reasonably low because the mortgage is a variable-rate loan at 2.5 per cent, which is well below today’s market rates. TD was charging three months’ interest to break this loan, as is the custom with variable-rate mortgages. With other types of mortgages, the penalty is the greater of three months’ interest or an interest rate differential, which is used by banks to compensate themselves for lost revenue on your loan.

Now for the various fees quoted listed in the TD quote for repaying the mortgage in full:

Mr. Gaetano said mortgage termination costs vary among lenders, but the typical practice is to charge just a mortgage penalty and a discharge fee. “I look at all these costs as a disloyalty charge. They’re saying, ‘If you don’t want to bank with us, you’re going to pay through the nose.’ ”

He took particular exception to the reinvestment fee, given that today’s rates for variable-rate mortgages are in the area of 3 per cent. Terminating a mortgage at 2.5 per cent is actually a money maker for the bank.

TD said in an e-mail that it has charged the reinvestment fee since May 2006 on newer mortgages that are in their first term and have not yet been renewed by the customer. “This fee helps cover the cost of acquiring and funding a mortgage,” the bank said. As for the transfer fee, TD said it applies when a customer moves a mortgage to another bank. Why it was charged in this case, where the mortgage was to be paid in full, is a mystery.

The so-called government charge for discharge is also worth noting. TD said it relates to the cost associated with discharging a mortgage through Ontario’s municipal electronic registration system. Mr. Gaetano said charging this cost in addition to the discharge fee “would be like buying lemonade from the lemonade stand and being charged $1 for the lemonade and $0.50 for the lemons.”

It’s worth noting that 40 per cent of clients at Mr. Gaetano’s firm renegotiate or pay out their mortgages before they mature. The obvious lesson here: Inquire about termination penalties at the time you’re setting up the mortgage.

The second fee that demonstrates the need for vigilance is the “minimum annual household fee” introduced by full-service brokerage BMO Nesbitt Burns in October. The firm has decided it wants a minimum $500 in fees per household (multiple accounts can be aggregated) and, if there’s a shortfall with fees currently charged, the difference will be billed to the client.

Mary Grant, a 58-year-old on disability, received notice a few months ago. Her sole holding with BMO is a $45,000 bond maturing this summer and she was previously paying an annual fee of $125. “My gut reaction was, first, anger, and, second, the feeling of being victimized,” Ms. Grant said.

BMO’s explanation of the minimum annual household fee suggests its Nesbitt Burns division is trying to weed out small accounts and route them to in-branch financial planners or the bank’s online brokerage, BMO InvestorLine. “Our full-service model is best suited for clients who require a broader range of wealth advisory services, which can include financial planning, tax and estate planning, insurance, and planned giving,” the bank said in an e-mail.

Ms. Grant makes a very good point about BMO’s new fee, which is that it should be disclosed right on the account statement and not just in a brochure that came in the same envelope. Fortunately, she’s a savvy customer who makes a habit of at least glancing at notices like this. “It’s always the fine print that surprises you.”

In 2013, prepare for surprises.

Breaking a Mortgage - See For Yourself: See Below or check Rob Carrick's posting of the TD mortgage quote and info about BMO’s minimum household fee by Clicking Here:Facebook personal finance page .

Happy Mortgage Hunting!

Natasha Shaw

Your Accredited Mortgage Professional

|AMP|BMgt|REIN Diamond Member|

VERICO Canada Mortgage Direct

Direct: 1|888|378|2821 (Toll Free)

Fax: 1|866|604|2528

Email: mtg@natashashaw.com

Web: http://natashashaw.com/

My Assistant & Support Team is:

Connie Woo ~ docs@natashashaw.com

18 Feb

Canadians pay the most in banking fees in the World! Marketplace broadcast to Canadians interviewing the banks and families on just how much money…

21 Jan

Welcoming all my clients, friends and family to a Happy New Year and a bright exciting new Era! Click Here to check out my 2012 Recap and 2013…

21 Jan

Armchair Landlord Event Announcement Wanna be a Landlord or own Revenue Property but don't want to do the grunt work? Come…